Middle market businesses continue to face unprecedented challenges, as COVID-19 heightened certain risks while introducing others. Data from Chubb and the National Center for the Middle Market (NCMM) shows that even though two-thirds (67%) of middle market companies are doing much or somewhat better than they were prior to the pandemic, COVID-19’s effects still loom large in a variety of ways, including lingering supply chain constraints.

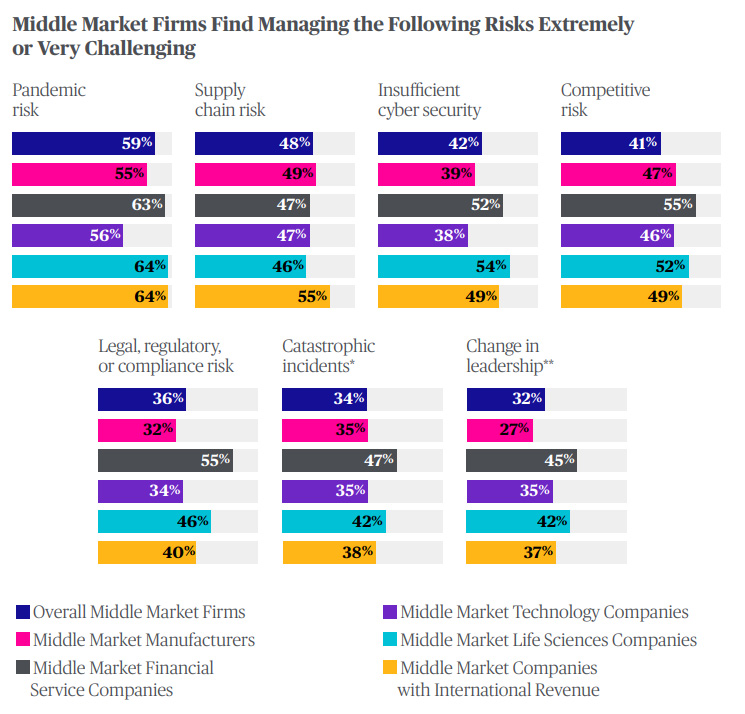

When middle market executives were asked how challenging they find managing various risks, supply chain issues were top of mind, behind only pandemic risk. Nearly half (47%) said that they were directly impacted by supply chain disruptions in the past six months, showcasing how concerning it is for risk executives.

Supply Chain Disruption Continues to Pose Threats

Middle market companies across industries are feeling supply chain pressures. According to the data, 49% of middle market technology companies were directly impacted by supply chain constraints or disruption in the prior six months with 54% of middle market financial services companies and 59% of middle market manufacturers saying the same.

The challenges presented by supply chain disruption are far from over, as middle market companies are well aware: Three-quarters (76%) of respondents said supply chain disruption would negatively impact revenue projections for the year ahead.

That said, of the middle market firms that were directly impacted by supply chain disruption or constraints in the six months leading up to the survey, 32% are purchasing from an alternative source to help mitigate risk. Another third (31%) are diversifying their suppliers, looking for them in multiple geographic regions, with the next cohort saying they are keeping excess inventory on hand (31%).

Impact of the Labor Shortage

The labor shortage is also top of mind for middle market companies. Per the survey data, 51% of middle market companies are finding it hard to hire employees with the appropriate skills for the jobs available. Slightly more than half (54%) of these companies reported that, as a result, employees are working longer hours and more shifts.

Since overstretched employees may be more prone to injury or costly mistakes, middle market companies must monitor workforce needs. This will not only help protect employee wellbeing, but also business health. In addition to helping minimize the potential for workers’ compensation claims, an appropriately staffed workforce can facilitate greater productivity. Of middle market companies struggling to hire, 32% experienced a slowdown in productivity and sales.

Leveraging Insurance Agent and Broker Expertise

Middle market businesses continue to face a number of complex risks, which underscores their need for comprehensive risk management and insurance programs. So as businesses face an ever-evolving risk landscape, it’s important to choose the right agency and insurance carrier with the insights and expertise to ask the right questions and deliver the right solutions.

Ben Rockwell is Division President, Chubb Middle Market.

The opinions and positions expressed are the authors’ own and not those of Chubb. The information and/ or data provided herein is for informational purposes only and is not a substitute for professional advice. Insurance coverage is subject to the language of the policies as issued.